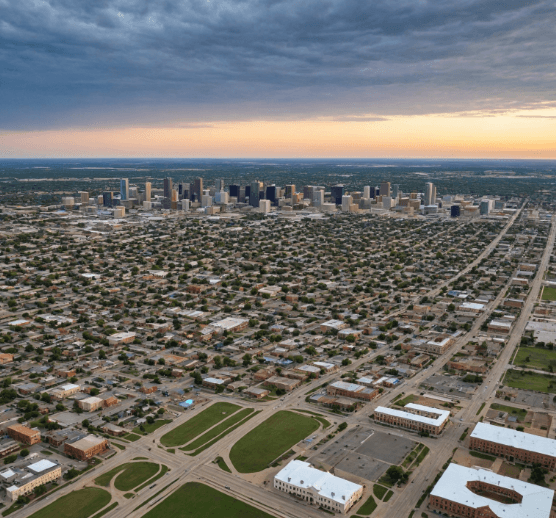

Getting the right Oklahoma auto insurance quotes can feel a lot like running a maze, with the various options and factors that need to be kept in mind. And if you are scratching your head and pondering where to begin, then you are not alone.

A Guide to Oklahoma Auto Insurance Quotes 2024

This article is going to act as your roadmap to help you understand and gain the best Oklahoma auto insurance quotes without the hassle or headache.

Understanding the Basics of Auto Insurance

What is Auto Insurance?

Auto insurance is there to catch you if you hit a bump in your journey due to an accident, theft, or natural disaster. In Oklahoma, it’s not just an option; it’s the law.

Types of Auto Insurance Coverage

You can consider auto insurance broken down into liability, collision, and comprehensive coverage. All of these types of coverage protect you in different ways against financial losses from an accident or other loss.

Decoding Oklahoma Auto Insurance Quotes

Factors Affecting Quotes

Wonder why your neighbor is paying less for auto insurance? Unravel the mystery by exploring what elements affect your quotes for Oklahoma auto insurance—from your driving record to the car you drive.

Shop Smart: Comparing Quotes

Shopping for auto insurance doesn’t mean ‘one glove fits all.’ Comparative shopping is a genius way to shop for auto insurance quotes with different providers. Learn how to have the best coverage at the most reasonable price.

How to Navigate the Oklahoma Auto Insurance Market

Best Oklahoma Insurance Providers

Not every auto insurance provider stands equal. Take a look at some of the best insurance companies in Oklahoma and why they’re special. Your decision counts. Knowing the difference will save you dollars and lots of frustration down the line.

Legal Requirements in oklahoma auto insurance quotes

Know the legalities of Oklahoma’s auto insurance. Do a little homework to find out what the state requires so that you can rest easy knowing that you are meeting all the criteria required of you by law to stay on the right side of the law while at the same time protecting yourself out on the road.

Lowering Your Auto Insurance Premium: Some Helpful Tips

Safe Driving Habits: Your Key to Savings

Your insurance cost is based on your driving record. Learn how using responsible driving practices will not only save you money on your auto insurance but act as a method to save yourself and others from potential dangers on the road.

You’re Not Getting These Discounts

There are a whole litany of discounts available from most insurance companies that their policyholders do not take advantage of, from safe driver discounts to policy bundling. Discover the hidden savings for you.

Mastering the Fine Art of a Thorough Auto Insurance Policy

Customizing Your Coverage

Your auto insurance should reflect your needs individually. Learn the fine art of tailoring your coverage to ensure that you are adequately protected but do not get huge expenses overblown on what may be unnecessary policies.

Reading Between the Lines: Policy Documents Explained

Understanding the fine print in your auto insurance policy is very important. Go through the key sections of your policy documents and ensure that you know exactly what you are covered for, and any potential exclusions.

Conclusion

In the complicated world of Oklahoma auto insurance quotes, knowledge is power. Having the assurance that you are armed with this guide empowers a person to know through options and find the right coverage at the best possible rates. Besides, it is not just meeting the legal requirement but peace of mind on every journey one takes.

Frequently Asked Questions

What are Oklahoma’s minimum auto insurance requirements?

- You will be required to have a minimum of liability insurance if you want to legally drive a motor vehicle in Oklahoma.

- How do I save money on my auto insurance?

- You can save through three ways: safe driving, good credit and discounts.

- Am I required to have comprehensive coverage in Oklahoma?

- While there is no state law requiring it, this policy may actually save you money from the non-collision events such as theft or natural disaster

Can I switch insurance providers easily?

You can change insurance providers anytime; however, you should consider the expiration date of the policy and possible cancellation fees.

What do I do after I have been in an automobile accident in Oklahoma?

After checking that you and other individuals involved are safe, exchange information with the other party. Afterward, document what happened at the scene. Then notify your insurance carrier by filing a claim as soon as possible.