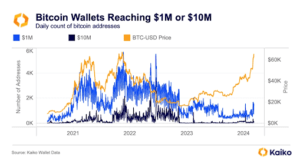

It recently hit a bull run inside the marketplace, with a massive gain in value and the rise of Bitcoin millionaire wallets. Below is an in-depth look at these factors and the implications of this trend:

Factors Contributing to the Bitcoin Bull Run:

- Halving Event: The event of halving, which takes place every four years, cuts by half the reward of the new blocks. With supply reduced by the event, this is supposed to raise the price of Bitcoin, assuming that the demand stays intact or goes higher, as in most cases. This fueled hope with the expectations of the next event in 2024 and provided more meat to the bulls.

- Institutional Investment: Building interest and investment by institutional investors have pumped very substantial capital into the Bitcoin market. Thus, due to such an institution by institutions as a hedge against inflation and store of value, it gives further impetus to the legitimacy of its price.

- Macro-Economic Factors: Fears of inflation and the devaluation of fiat currencies have changed global economic conditions, forcing many investors to seek alternative stores of value. Bitcoin, often referred to as “digital gold,” benefits from this shift in investment strategy.

A recent analysis by Kaiko outlined some key reasons why there is a slowdown in the creation of Bitcoin millionaire wallets despite the ongoing bull run.

While slower than in previous cycles, the 2024 Bitcoin bull market is expected to continue its upward trajectory.

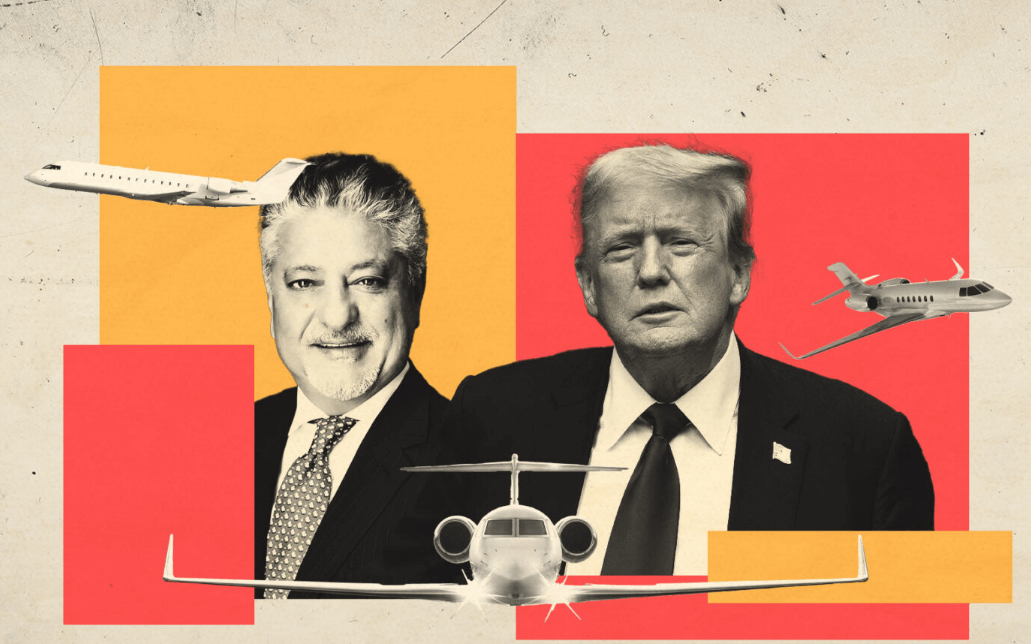

With the approval of Ethereum ETFs, more cryptocurrency ETFs are likely to be approved, pumping more capital into the crypto space. Also, the approaching US election is likely to boost the bull market currently running as Donald Trump voiced in support of digital currencies. The approach to this, among other factors, shall be broken down here for possible implications.

Increased Crypto ETFs

- Capital Inflow: The green light for Ethereum ETFs and more cryptocurrency ETFs expected to follow will likely attract serious institutional and retail investment into the crypto market. ETFs give an easier and more regulated route to cryptocurrencies, which means that exposure could get a deluge in capital inflow.

- Market Expansion: If ETFs could be made available for various cryptocurrencies other than Bitcoin and Ethereum, then it could, in theory, make the crypto market more attractive to a wider pool of investors. Consequently, prices might appreciate across tokens of different types.

More Crypto Millionaires In This Bull Run Thanks To Meme Coins

The new surge in meme coins, especially in the recent bull run, has really brought more crypto millionaires. Here’s a closer look at the phenomenon and its implications:

Rise of Meme Coins

- Stronger Adoption: Meme coins have never been more prevalent in this market cycle. The reasons could be that they were often humorous or satirical in nature, along with the fact that their virality in social media and the fast profitmaking out of trading into this fame.

- Daily Creation: With the surge of meme coins, new tokens proliferate daily. These coins are in active trading amongst crypto investors, who profit from their high volatility and very speculative nature to garner hefty returns.

Success Stories

- Attention Solana Meme Coin Traders: Cases of the Solana meme coin traders who gain millions off of relatively modest initial investments show how a person could make huge gains in meme coin trading. This, in turn, as all the success stories do, attracts more and more interest in the market for meme coins, further feeding this growth.

- Dogwifhat (WIF) Example: Turning $1,800 into almost $11 million exemplifies the returns possible in meme coin trading. These stories capture the attention of the wider crypto community and draw increased interest towards meme coins.

Leave a Reply