The recent bull run in the Bitcoin market has indeed led to significant price increases and a notable rise in the number of Bitcoin millionaire wallets. Here’s a deeper look at some of the factors and implications of this trend:

Factors Contributing to the Bitcoin Bull Run:

- Halving Event: The halving event, which occurs approximately every four years, reduces the reward for mining new blocks by half. This reduction in supply, coupled with sustained or increasing demand, typically drives up the price of Bitcoin. The anticipation of the next halving event in 2024 has contributed to the bullish sentiment.

- Institutional Investment: Increased interest and investment from institutional investors have provided substantial capital inflows into the Bitcoin market. Institutions see Bitcoin as a hedge against inflation and a store of value, which boosts its legitimacy and price.

- Macro-Economic Factors: Global economic conditions, including concerns about inflation and the devaluation of fiat currencies, have led investors to seek alternative stores of value. Bitcoin, often referred to as “digital gold,” benefits from this shift in investment strategy.

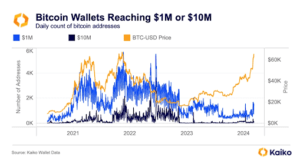

The analysis from Kaiko highlights several important factors contributing to the current slowdown in the creation of Bitcoin millionaire wallets despite the ongoing bull run.

The Bitcoin bull market of 2024, while starting slower compared to previous cycles, is anticipated to maintain an upward trajectory.

The anticipation of more cryptocurrency ETFs, particularly with the approval of Ethereum ETFs, is poised to inject additional capital into the crypto space. Furthermore, the upcoming US election is projected to have a positive impact on the ongoing bull market, especially given Donald Trump’s expressed support for cryptocurrencies. Here’s a breakdown of these factors and their potential implications:

Increased Crypto ETFs

- Capital Inflow: The approval of Ethereum ETFs, along with the expectation of more cryptocurrency ETFs, is likely to attract significant institutional and retail investment into the crypto market. ETFs provide an accessible and regulated way for investors to gain exposure to cryptocurrencies, potentially leading to a surge in capital inflow.

- Market Expansion: The availability of ETFs for various cryptocurrencies beyond Bitcoin and Ethereum could broaden the appeal of the crypto market to a wider range of investors. This expansion may drive up prices across different tokens as demand increases.

More Crypto Millionaires In This Bull Run Thanks To Meme Coins

The surge in meme coins during this bull run has indeed contributed to the creation of more crypto millionaires compared to previous cycles. Here’s a closer look at the phenomenon and its implications:

Rise of Meme Coins

- Increased Adoption: Meme coins, characterized by their often humorous or satirical nature, have gained significant adoption in this market cycle. Their popularity stems from viral social media trends and the potential for quick profits through trading.

- Daily Creation: The upsurge in meme coins has led to a proliferation of new tokens daily. Crypto investors are actively trading these coins, capitalizing on their volatility and speculative nature to generate substantial returns.

Success Stories

- Solana Meme Coin Traders: Instances like the Solana meme coin traders who made millions with relatively modest initial investments highlight the potential for significant gains in meme coin trading. These success stories attract more investors to the meme coin market, further fueling its growth.

- Dogwifhat (WIF) Example: The Dogwifhat (WIF) meme coin trader turning $1,800 into almost $11 million exemplifies the extraordinary returns possible in meme coin trading. Such stories capture the attention of the wider crypto community and draw increased interest towards meme coins.